Shaun Pruitt

·3 min read

The impact of easing inflation has allowed several financial transaction services companies to continue their sound growth and expansion with none having a wider reach than Visa Vand Mastercard MA.

Visa and Mastercard products are used for an array of consumer and enterprise purchases globally whether it be debit or credit transactions among other mobile, web-based, and electronic-related payment solutions to financial institutions.

Of course, Visa and Mastercard shares tend to rip higher when the broader economic environment is more stable and now is a good time to see if investors should buy stock in these global payment solution leaders.

IntriguingPerformance Overview

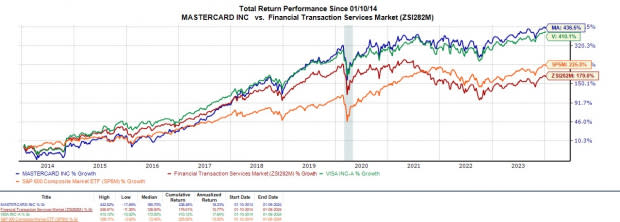

Over the last year, Visa’s stock is up +20% to top Mastercard’s +13%, and the Zacks Financial Transaction Services Markets’ +14% although this has trailed the S&P 500’s +23%. Taking the last three years into account, Visa’s +23% and Mastercard’s +21% has largely outperformed their Zacks Subindustry’s -15% and is near the benchmark’s +25%.

Image Source: Zacks Investment Research

This has only added to their brilliant historical performances with Mastercard’s total return now at +436% over the last decade when including dividends and Visa at +410%. During this period, it's noteworthy that both have impressively beaten the S&P 500’s +226% and their Zacks Subindustry’s +179%.

Image Source: Zacks Investment Research

Expansive Growth Trajectories

Notably, Visa and Mastercard are expected to have posted stellar growth over the last quarter with their quarterly reports scheduled for January 25.

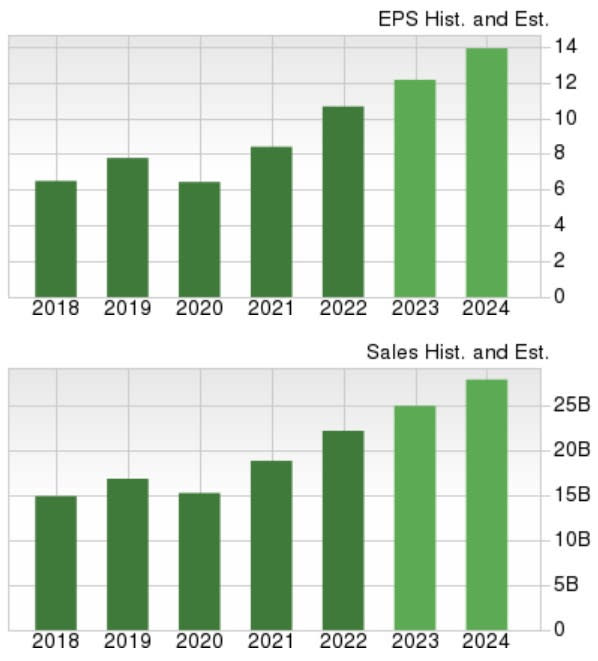

Mastercard especially stands out with the company expepected to round out its fiscal 2023 with fourth quarter earnings soaring 16% year over year to $3.07 per share versus $2.65 a share in Q4 2022. On the top line, Q4 sales are projected to jump 11% to $6.45 billion.

Overall, Mastercard's annual earnings are thought to have expanded 14% in FY23 to $12.16 per share compared to $10.65 a share in 2022. Even better, FY24 earnings are projected to expand another 16% to $14.18 per share. Plus, total sales are expected to have risen 12% in FY23 and are anticipated to leap another 12% this year to $28.09 billion.

Image Source: Zacks Investment Research

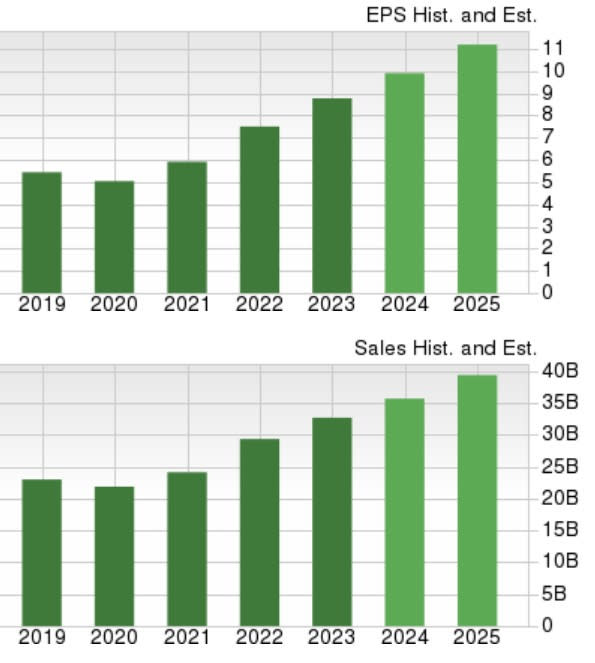

Already being in its fiscal 2024, Visa’s first quarter earnings estimates are currently slated at $2.33 a share which would be up 7% YoY. First quarter sales are projected to rise 7% as well to $8.51 billion versus $7.94 billion in the comparative quarter.

Visa’s annual earnings are expected to rise 13% in FY24 and jump another 12% in FY25 to $11.14 per share. Total sales are projected to be 9% higher this year and climb another 10% in FY25 to $39.27 billion.

Image Source: Zacks Investment Research

Bottom Line

With such a robust and expansive top and bottom line, Mastercard’s stock currently sports a Zacks Rank #2 (Buy) while Visa shares land a Zacks Rank #3 (Hold). With that being said, the growth of both companies remains compelling and strong quarterly results later in the month could be the next catalyst to continuing their very stellar decade performances as investors eye deflationary winners.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report